When Can I Renew Pagibig Multipurpose Loan

Read more below and learn how to secure cash through the Pag-IBIG Multi-Purpose Loan. Currently available for the Pag-IBIG Fund Housing Loan.

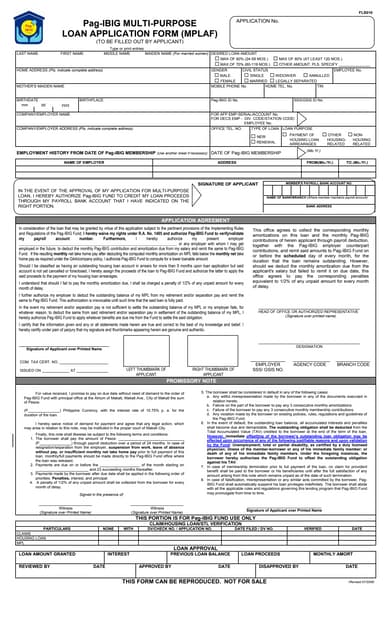

Pdf Slf001 Multi Purpose Loan Application Form Mplaf V01 Randel Aquillo Academia Edu

The Pag-IBIG Salary loan is payable for a maximum period of 24 months.

When can i renew pagibig multipurpose loan. You can make your monthly repayments through salary deduction over-the-counter-payments or other types of payments approved by Pag-IBIG. Upon the time of release you will have a two 2 month grace period before you need to repay the amount in full. Outstanding balance interest and penalties shall be deducted from the MPL.

Penalties and charges will be deducted from the new amount you take out. The property is not yet foreclosed. Provided a sufficient proof of income.

The balance will be deducted to the the new loan that you will be getting. SSS maximum amount is Php 32000 given that your posted contributionss already at 73 months and for the last 12 months na sa ceiling yung monthly remittance mo - Php 179000. If you have an existing calamity loan you can only avail of MPL Multi-Purpose Loan if you complete at least 6 monthly amortizations.

The national agency will begin receiving applications once the enhanced community quarantine is lifted. For those existing Pag IBIG Fund housing loan MPL or Calamity loan the account must not be in default Must submit the proof of income MPL Loan amount and Interest Rate. REQUIREMENTS ON RENEWING PAGIBIG SALARY LOAN 1.

You may renew your MPL after paying an equivalent of six 6 monthly amortizations and upon satisfying the qualifications mentioned above. It may not be wise but you are allowed to renew your short-term loan upon payment of at least 6 months. We hope we have helped you with regards to this matter.

The outstanding balance together with any accrued interests penalties and charges shall be deducted from the proceeds of the MPL. How soon can I apply again for a Pag-ibig Multi-Purpose Loan or Short-term Loan. If you are looking for a loan renewal there is a different set of requirement.

You may renew your Pag-IBIG Salary Loan application granted that you have paid for at least six months of amortization. The Multi-Purpose Salary Loan and Calamity Loan will be treated as separate if you were able to pay the latter. In the same manner I hereby express my consent for Pag-IBIG Fund to collect record.

The outstanding balance of your existing loan shall be deducted from the loan proceeds of your new loan. Posted at least one 1 MS within the last six 6 months. According to an article on Cash Mart the Pag-IBIG Salary Loan renewal is possible after paying at least six 6 monthly amortizations of your existing loan.

If Member has existing calamity loan a member shall be allowed to avail of the Multi-Purpose Loan only after payment of at least six 6 monthly amortizations. Your remaining balance will be deducted from your new loan. At least made a 1 month saving within the last six months prior to the date of loan application.

If you are looking for a loan renewal there is a different set of requirements. If you have already paid at least 6 months you can renew your loan. To be eligible for the multi-purpose loan offer the borrower must have.

Also your current loan may be credited from your new loan. The balance of the existing MPL will be deducted from the allowable loan threshold 80 of Pag-IBIG Regular Savings and the difference shall be allocated. Thank you for visiting our website.

You can also apply for loan renewal later on though it will require six months worth of payments towards your existing loan plus the outstanding balance together with any accumulated interest. And you can also increase your contributions from 200 to wantusawa. His or her Pag-IBIG Housing Loan or Calamity Loan in default in case there is.

I still have an existing loan from PAG-IBIG but you can renew your loan as long as there is already a payment of atleast 6 months. With Pag IBIG 60 70 to 80 ng Total Accumulated Value TAV mo ang pwede ma loan. The Pag-IBIG Fund Multi-Purpose Loan or MPL is a cash loan designed to help our members with any immediate financial need.

Posted at least twenty-four 24 monthly savings. A member can have an existing Pag-IBIG Fund MPL and still apply for Calamity Loan as long as the member is updated with the payment of monthly contributions prior to the enhanced community quarantine done on 16 March 2020. The outstanding loan balance will be deducted from the new loan.

To Apply For A Loan Renewal A Pag ibig Member Must Have. You can apply again after you have paid at least 6 monthly amortizations and you have made 5 monthly contributions or savings within the last 6 months prior to new loan application. When can I renew my MPL.

Outstanding balance interest and penalties shall be deducted from the MPL. I have read about the Data Privacy Statement as well as the Pag-IBIG Fund Privacy Policy and express my consent thereto. This also applies for renewal of Calamity Loans.

You can submit your application at the nearest Pag-IBIG Fund branch until June 15 2020. Aside from the online application of multi-purpose and calamity loan funds Pag-IBIG offers virtual services accessible at their official website. Access our Online Housing Loan Application System by clicking continue.

In case your housing loan is already over 9 months in arrears you may still be allowed to avail of the Multi-Purpose Loan if the account has not yet been cancelled or foreclosed and the proceeds of the loan shall. If you have an existing calamity loan you can only avail of MPL Multi Purpose Loan if you complete at least 6 monthly amortizations. A member can borrow up to 80 of their Pag-IBIG Regular Savings and can be processed in as fast as 2 days.

With payment of at least 6 monthly amortizations.

Pdf Multi Purpose Loan Mpl Application Form Application Agreement Promissory Note Ambhet Casi11 Academia Edu

Are You Really Qualified For Pag Ibig Multi Purpose Loan In 2019

Sss Salary Loan Vs Pag Ibig Multi Purpose Loan Understanding The Differences

Pag Ibig Multi Purpose Loan Must Know Details Before Applying

Pag Ibig Multi Purpose Application Form

Komentar

Posting Komentar