How Much Is The First Salary Loan In Pag Ibig

If the house cost Php 40000000 to Php 125000000 90 of the amount can be loanable to Pag ibig. Pag-IBIG offers a maximum loanable amount of PHP 6 million.

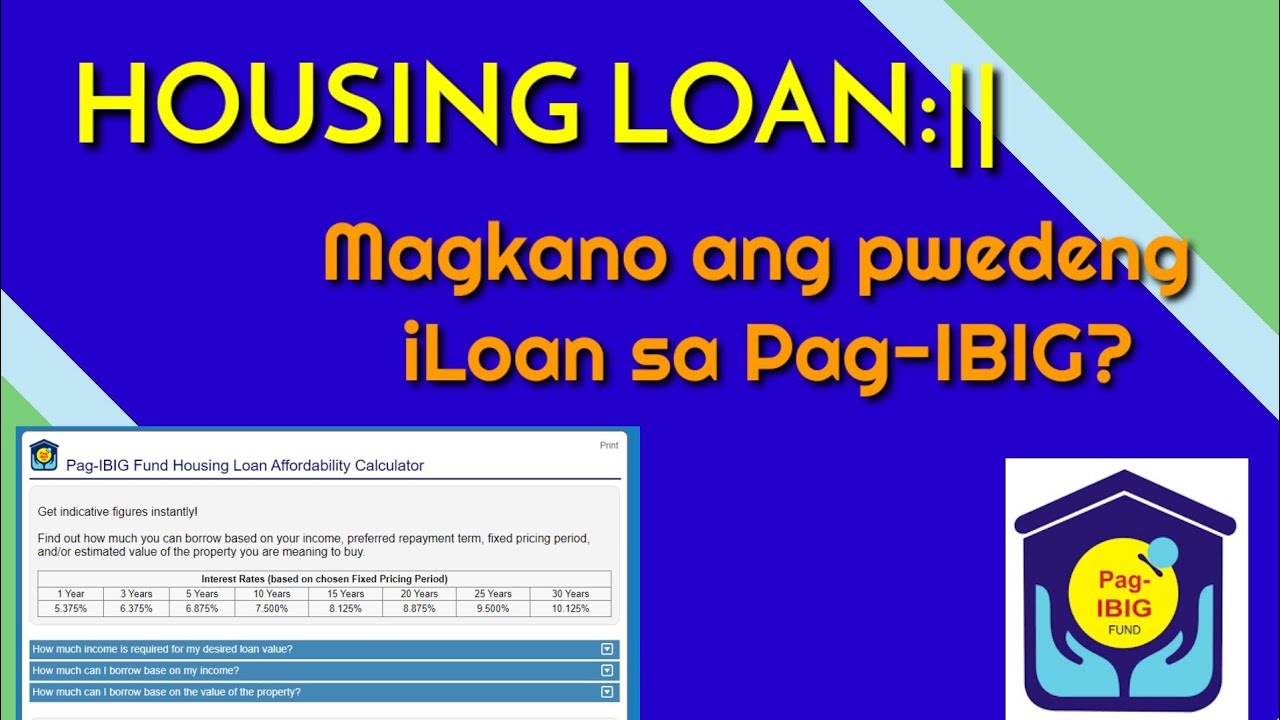

Pag Ibig Housing Loan Magkano Ang Pwede Iloan Sa Pag Ibig 2020 Hdmf Affordability Calculator Youtube

The members actual need.

How much is the first salary loan in pag ibig. The Loan Amount Loan to Appraisal value ratio is. 60 119 Months. PAG-IBIG CALAMITY LOAN 2020 Here is a guide on how to apply for this Pag-IBIG Fund loan offer and how much you may borrow under it.

The monthly contribution to Pag-IBIG Fund is Php 20000. Nowadays a lot of people are undeniably needing some cash. Do you want to know how much you can borrow under the Pag-IBIG Salary Loan.

Next is the second calculator. Check the number of your total monthly contributions to Pag-IBIG Fund Multiply the total number of your monthly contributions with Php 20000. If the house cost up to Php 40000000 100 of the amount can be loanable to Pag ibig.

A qualified Pag-IBIG member shall be allowed to borrow an amount up to a maximum amount of Six Million Pesos P600000000 which shall be based on the lowest of the following. The total loan amount each member is entitled to will depend on two factors. Therefore the signNow web application is a must-have for completing and signing pag ibig salary loan online application 2020 on the go.

Some have very little savings while others have none. If the house cost up to Php 40000000 100 of the amount can be loanable to Pag ibig. Formally-employed members shall pay their loan amortization through a salary deduction arrangement with their employer.

How much is the first calamity loan in Pag ibig. That is censored for privacy matters To know how much Pag-IBIG can lend you and how much will be your monthly. The income required of 27 49459 is lower than my actual gross monthly income and the monthly amortization stated above is OK with me therefore I can avail the house and lot with the given Desired Loan Amount.

24 months Pag-IBIG membership x 200 monthly contribution 60 The amount you can loan rises as your monthly contributions increase and so does the loan factor. How much is the first calamity loan in Pag ibig. This refers to the Selling Price Projected Construction or Improvement Cost or Outstanding loan balance from Bank or Financing Institution.

Compared to the Pag-IBIG loan the SSS salary loan only lets you borrow an amount equivalent to one or two months of your salary with a maximum limit of P15000 and P30000 respectively. The first is the monthly contribution that a member can comfortably pay Pag-IBIG. If the house cost Php 40000000 to Php 125000000 90 of the amount can be loanable to Pag ibig.

What is the loan to appraisal value ratio. The loan is payable within 24 months and comes with a deferred first payment. You can make your monthly repayments through salary deduction over-the-counter-payments or other types of payments approved by Pag-IBIG.

A member can borrow up to 80 of their Pag-IBIG Regular Savings and can be processed in as fast as 2 days. Guide on How To Apply for Pag-IBIG Calamity Loan 2020 the Loanable Amounts. Should you choose the 30-year maximum loan period to pay off your housing loan keep in mind that the first 10 years will be basically spent paying off the interests alone.

How much is monthly Pag-IBIG contribution. The Pag-IBIG Fund Multi-Purpose Loan or MPL is a cash loan designed to help our members with any immediate financial need. A Comprehensive Guide To Pag-IBIG Multi-Purpose Salary Loan Application 4 min read By eCompareMo on June 10 2019.

Their Multi-Purpose Salary Loan is a short-term loan program for qualified borrowers. An employee who has made contributions for 120 months or more can take out a loan at an 80 factor. Although the maximum loan period is 30 years Pag IBIG recommends choosing an optimum period of 10 years or shorter to avoid paying higher interest.

To compute how much you may borrow if you will apply for Pag-IBIG Cash Salary Loan do the following. Up to 60 of the TAV can be borrowed. The amount you can borrow is based on the lowest amount among the following factors.

Based on PagIBIG Circular 310 following are the guidelines for determining a members loanable amount. Upon the time of release you will have a two 2 month grace period before you need to repay the amount in full. Members can borrow up to 80 of their Total Accumulated Value TAV subject to the terms and conditions of the program.

Based on an article on Cashmart the loanable amount will depend on your total accumulated value or TAV. Generally members can get a housing loan from Pag-IBIG from P100000 to P3000000. 24 59 Months.

Pag-IBIG Fund was established as a national savings program to provide financial assistance for both private and government employees. For questions or to follow-up on your loan application please call 028724-4244 or chat us by clicking on the icon found at the bottom right of your screen. For example your TAV is Php 2500000 you can borrow up to Php 1500000.

Calamity Loan Interest rate is 595 per annum. The Pag-IBIG Salary loan is payable for a maximum period of 24 months. Get pag ibig salary loan online application 2020 signed right from your smartphone using these six tips.

Read more below and learn how to secure cash through the Pag-IBIG Multi-Purpose Loan. Self-employed individuals Overseas Filipino Workers OFWs and all other individual payors may their amortization at any of our Pag-IBIG Fund. To qualify for a one-month salary loan you should have made at least 36 monthly contributions in the past six of them within the last 12 months.

In a matter of seconds receive an electronic document with a legally-binding e-signature.

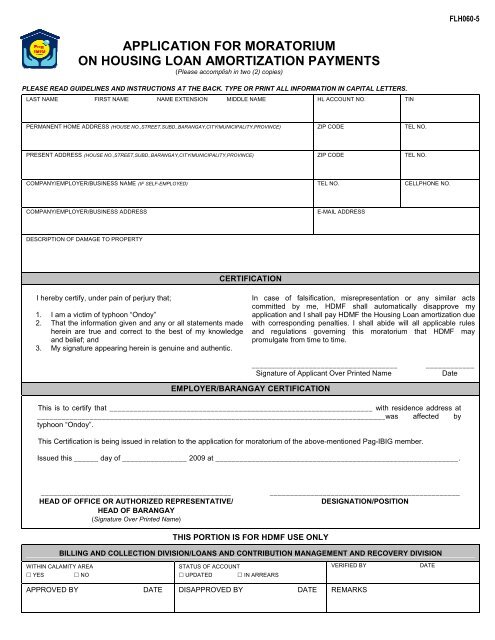

Flh060 5 Application For Moratorium On Hl Amortization Pag Ibig

Pag Ibig Salary Loan Requirements And Eligibility Coins Ph

Pag Ibig Vs Bank Housing Loan Visual Ly

Guidelines And Instructions Certificate Of Net Pay A Who May File Loan Application Calamity Application Form

Get A Pag Ibig Multi Purpose Loan Pag Ibig Fund Hdmf Facebook

Komentar

Posting Komentar