Can I Apply For Pag Ibig Calamity Loan With Existing Salary Loan

The MPL comes at an interest that is low of 105 per cent per year. With regards to the query on until when an eligible member may avail the Pag-IBIG Calamity Loan according to the government agency the application must be made within 90 days since the state of calamity declaration was made.

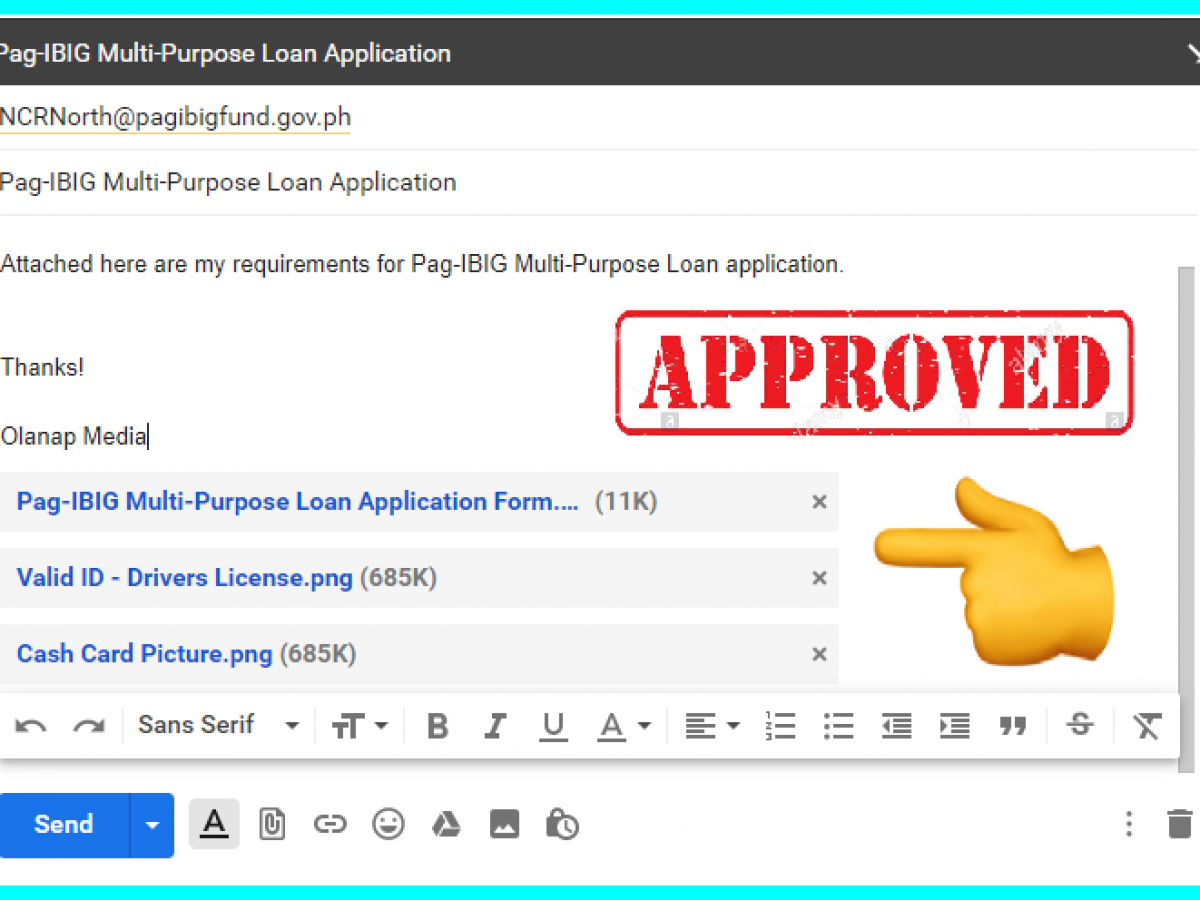

How To Apply For Pag Ibig Multi Purpose Loan Using Email Olanap Media

Eligibility for Moratorium on Pag-IBIG Loans If you have an existing MPL and CL do note that Pag-IBIG has offered a three-month moratorium on payments due on March 16 to June 15 2020.

Can i apply for pag ibig calamity loan with existing salary loan. Pag-IBIG Fund members should keep in mind that having an existing Pag-IBIG Housing Loan does not disqualify them from being eligible for the Calamity Loan. If you have an existing calamity loan you can only avail of MPL Multi-Purpose Loan if you complete at least 6 monthly amortizations. Latest payslips equivalent to a months wage.

Ang pagpirma sa Application Agreement o pagpapadala ng Employer Confirmation of STL Application ng inyong employer ay sapat na upang magpatunay na kayo ay may kakayahang humiram sa MPL or Calamity Loan program ng Pag-IBIG Fund at nagpapakita ng pagsang-ayon nila na ibabawas sa inyong suweldo ang buwanang bayad sa inyong loan sa oras na ito ay kailangang bayaran na. For you to qualify if you have an existing Pag-IBIG Fund Housing Loan MPL andor Calamity Loan your payments must be updated. The Pag-IBIG Fund Calamity Loan is a cash loan facility to assist Pag-IBIG Fund members who reside in areas declared under a state of calamity and are affected by such disasters.

According to Pag-IBIG Fund you may still be eligible to apply for its multi-purpose loan offer even if you have an existing calamity loan provided that you are active in paying for your existing loan. Thank you for visiting our website. If you have an existing calamity loan the Pag-IBIG Cash Loan proceeds may be the difference between 80 of your Pag-IBIG Regular Savings.

Heres how you can file your application through this standard method. If you have an existing housing loan and you want to avail of another one Pag IBIG may allow you to qualify as long as you meet their eligibility requirements. Photocopies of two valid photos and two signature-bearing IDs.

At the time of the Facebook announcement those in Luzon and. However if you have an existingoutstanding Pag-IBIG Calamity Loan and your area is hit with a second calamity you can avail of another calamity loan anytime. With the payment of at least 6 monthly amortizations.

Note that Pag-IBIG members with an existing Pag-IBIG Housing Loan or Pag-IBIG Calamity Loan must not have a default account in the date of application. The loan seeks to provide immediate financial assistance to help members recover from the effects of such calamity. Multi-purpose Salary Loan MPL This is a cash or salary loan offered by Pag-IBIG to its members who have religiously settled their monthly premiums for 24 straight months.

With Pag-IBIG Funds MPL program qualified members can borrow up to 80 of their total Pag-IBIG Regular Savings which consist of their monthly contributions their employers contributions and accumulated dividends earned. For this loan you can apply within 90 days from the State of. However their existing loans must not be in default.

According to the government agency a member with other existing loans can still apply for Pag-IBIG Cash Loan provided that they have updated payments for his or her existing loans. The outstanding balance of the first calamity. A member can have an existing Pag-IBIG Fund MPL and still apply for Calamity Loan as long as the member is updated with the payment of monthly contributions prior to the enhanced community quarantine done on 16 March 2020.

The same thing works for Pag-IBIG Housing Loan. Its a special type of loan granted only to members in areas declared under the State of Calamity. 3 How much may I borrow.

PAG-IBIG SALARY LOAN How To Apply Requirements To Prepare. Pag-IBIG Salary Loan Requirements. The difference depends on the loanable amount.

Qualified members may borrow up to 80 of their total Pag-IBIG Regular Savings which consist of their monthly contributions their employers contributions and accumulated dividends earned. If you have an outstanding Multi-Purpose andor Calamity Loan the amount of loan you will receive shall be the difference between the 80 of your total Pag-IBIG Regular Savings and the outstanding balance of. You may want to know how to apply for it and as well as the loanable amounts.

You would certainly be happy to realize that a significant area of the earnings derived by Pag-IBIG Fund through the loan system is came back to its members by means of dividends. If you are looking for a loan renewal there is a different set of requirements. For those who are affected financially and are in need of urgent assistance you can refer to our guide on how to apply online for Pag-IBIG Calamity Loan and have your request submitted as soon as you can.

You can apply for a calamity loan at any Pag-IBIG office within 90 days after your place of residence or work has been put under the State of Calamity provided that Pag-IBIG offices remain open and a nationwide lockdown hasnt been implemented. If you have If an existing Pag-IBIG Fund Housing Loan MPL andor Calamity Loan your payments must be updated for you to qualify. We hope we have helped you with regards to this matter.

It comes at a low interest rate of 595 per annum. Hence you can still avail of the Pag-IBIG Calamity Loan while you have an outstanding housing loan provided that the latter is not in default. Outstanding balance interest and penalties shall be deducted from the MPL.

It depends on the type of loan.

How To Apply For A Pag Ibig Calamity Loan Coins Ph

How To Apply For Pag Ibig Calamity Loan In 2020 Updated Guide

Pag Ibig Loan Everything You Need To Know Imoney

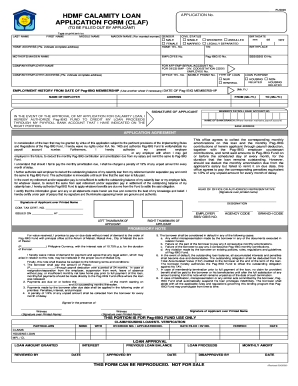

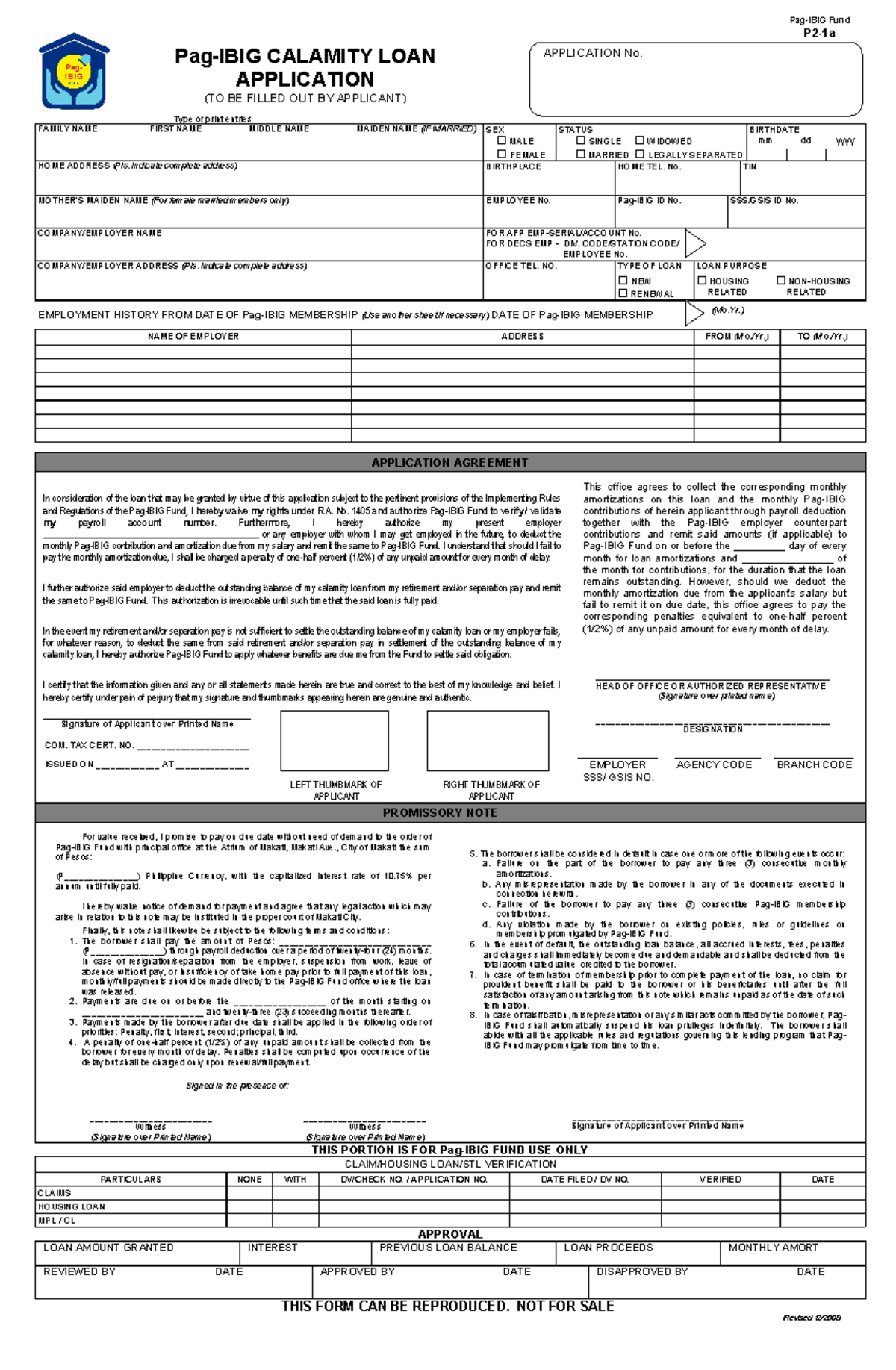

Pagibig Calamity Loan Form Studocu

Pag Ibig Salary Loan Application Dumaguete Philippines

Komentar

Posting Komentar