Sss Philhealth And Pag-ibig Fund Contributions Is Made By

Checking your Pag-IBIG PhilHealth and SSS contributions is a favor you do for the future. Pag-ibig Home Development Mutual Fund Pag-ibig was established to address the need for a national savings program and an affordable shelter financing for the Filipino workers.

Bir Sss Philhealth Pagibig Contribution Table Plus Guide To Solve Your Income Tax Ph Trending

Updated contributions are necessary before an employee claim any benefit such as Maternity Leave SSS Hospitalization discount Philhealth and Pag-ibig Loan and Provident Retirement Benefit Pag-ibigHDMF.

Sss philhealth and pag-ibig fund contributions is made by. Again it depends on your budget. Checking your contributions are now made easyTimp estimat de citire. SSS Pag-IBIG and PhilHealth.

Check your SSS PhilHealth and Pag-IBIG contributions regularly. So starting last July the BIR is collecting taxes on voluntary contributions made by citizens to the Social Security System SSS Government Service Insurance System GSIS Philippine Health Insurance Corp. Multiply your monthly premium by 12 and you have total annual contributions of Php 1009206.

What is a government contribution. PhilHealth and Home Development Mutual Fund Pagtutulungan sa kinabukasan Ikaw Bangko Industriya at Gobyerno or Pag-IBIG Fund. Since the 2021 premium rate is 35 your monthly PhilHealth premium based on your salary is Php 84105 Php 24030 x 0035.

How much When and Where to pay Pag ibig PhilHealth and SSS Contribution for Voluntary MemberDisclaimer. None of the choices. Most known for its affordable housing loans A Pag-IBIG membership also offers short-term loans for different purposes as well as robust savings programs.

It will then be easier to verify with your employer to make payments for unpaid contributions. Your contributions to Pag-IBIG PhilHealth and SSS is dependent on your budget. You can also verify your contributions at the SSS main office at East Avenue Quezon City.

3 question SSS philhealth and pag-ibig fund contributions is made by. The Home Development Mutual Fund HDMF or better known as the Pag-IBIG Fund is the national savings program and house financing plan for Filipinos. Three of these benefits SSS PhilHealth and Pag-IBIG Fund Contributions are administered by their respective government agencies through a monthly contribution scheme that requires the employer to remit a portion of the employees actual.

After deducting the monthly government contributions from your employees salaries remit them along with your employer share to Pag-IBIG PhilHealth and SSS branches or their authorized collecting partners such as banks Bayad Center and SM payment counters. Regradless of monthly salary employers contribution as well as your contribution your salary deduction is P100 and the total contribution that must be credited to your Pag-ibig number is P200. The 13 th Month Pay.

PhilHealth and Home Development Mutual Fund Pagtutulungan sa kinabukasan Ikaw Bangko Industriya at Gobyerno or Pag-IBIG Fund. With this the State established the Social Security System SSS the Home Development Mutual Fund Pag-IBIG and the Philippine Health Insurance Corporation PhilHealth. The employer must ensure also that all payments made are posted to employees individual account.

To save time and effort set an appointment online using MySSS. To access your SSS contributions though test message simply type SSSCONTRIB10-digit SSS number4-digit PIN then send it to 2600. So starting last July the BIR is collecting taxes on voluntary contributions made by citizens to the Social Security System SSS Government Service Insurance System GSIS Philippine Health Insurance Corp.

The higher you pay the more it will increase the cost of your Pag-IBIG benefits. This is just a portion of your salary that can help you in times of need. Contributing member like you may get the savings total contribution plus accumulated dividends when you reach any of the following.

With the goal to provide both savings and shelter to every Filipino. But a fixed part of your monthly budget can help you to not miss one. Meal and Rest Periods.

Yours should be up-to-date and remitted correctly so you can qualify for housing and salary loans from SSS or Pag-IBIG anytime you need to borrow money for your short-term needs. You dont have to pay this in full. Philippine Labor Code requires an employer to provide for their employees SSS PhilHealth and Pag-IBIG also known as HDMF.

Most companies will already automatically deduct these from your paycheck but in some cases like if youre self-employed you have to make the payments yourself. PHP 200 is the minimum of your monthly contribution. While you are still an active contributor as a current employee you might find out that there are periods months or years of premium payment gaps.

Home and Development Mutual Fund HDMF or otherwise known as Pag-ibig is a mandatory benefit given to employees. Both Employees and Employers D. GMA News TV program On Call.

The Philippine Social Security System is a social insurance program for workers which operates under two programs. This is what your employers deduct in your salary to pay your part in SSS Pag-IBIG Philhealth. You can use the loan benefits of these agencies may it be a salary loan calamity.

This video is for guide-purposes only. This will also prevent delays in your benefit and loan processing.

Is Your Employer Remitting Your Pag Ibig Philhealth And Sss Contributions Check Here Sss Guides

Sss And Pag Ibig Updates Grant Thornton

Pag Ibig For Everyone S Information

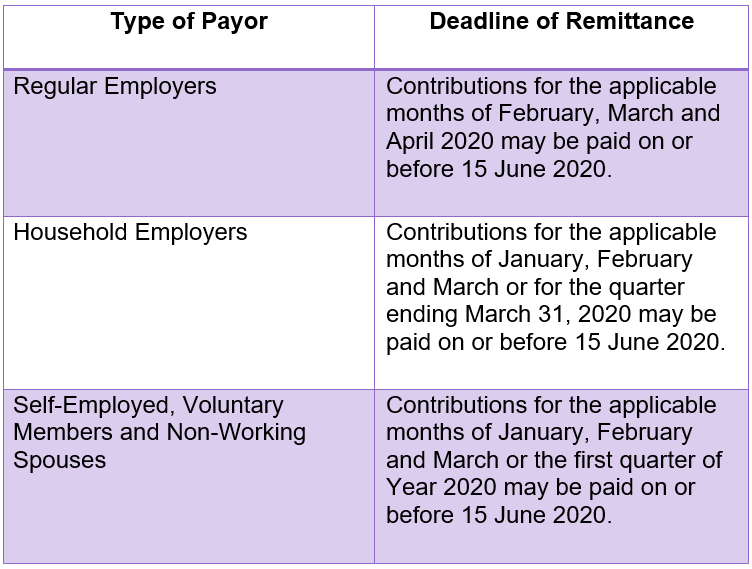

Sss Philhealth And Hdmf Pag Ibig Contributions Payment Deadline

Sss Pag Ibig Philhealth Alburo Alburo And Associates Law Offices

Komentar

Posting Komentar