Pag Ibig Multi Purpose Loan Renewal Requirements

This also applies for renewal of Calamity Loans. How to Apply for PAG-IBIG Multi-Purpose Loan.

Pdf Multi Purpose Loan Mpl Application Form Previous Employment Details From Date Of Pag Ibig Membership Use Another Sheet If Necessary Promissory Note Nilda Torres Academia Edu

The outstanding balance together with any accumulated interests penalties and charges shall be deducted from the proceeds of the new loan.

Pag ibig multi purpose loan renewal requirements. What is the maximum loan amount I can get from MPL. Has made at least of 24 months contributions. Borrower may renew after six months equivalent amortization and satisfying the eligibility requirements.

Your remaining balance will be deducted from your new loan. You have to complete at least 5 monthly contributions in the last 6 months. Two photocopied Identification Cards with 3 signatures.

Active or currently contributing to the Fund at the time of loan application. The renewal of your Multi-Purpose Loan will be after you have paid 6 monthly loan amortizations and upon satisfying the guidelines and requirements of the program. REQUIREMENTS ON RENEWING PAGIBIG SALARY LOAN 1.

Refinance an existing housing loan provided that the institution where you borrowed the money from is acceptable to Pag IBIG and that your account is updated at least 1 year upon application as supported by official receipts and a Statement of Account. To qualify for the MPL program the member must satisfy the following qualifications. We hope we have helped you with regards to this matter.

Also your current loan may be credited from your new loan. For minor home improvement or renovation you can avail of the Pag IBIG Multi-Purpose Loan instead. An active Pag-IBIG member at the time of loan application with at least one 1 monthly contribution for the last six months.

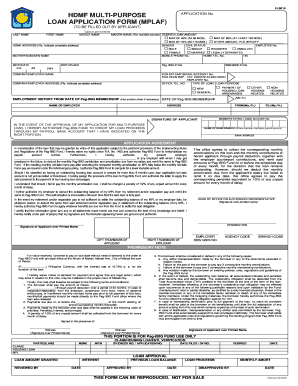

If you have an existing Pag-IBIG Fund Housing Loan MPL andor Calamity Loan your payments must be updated for you to qualify. Multi-Purpose Loan Application Form MPLAF signed by the Head Office or Authorized Representative from your office. 1Download the Pag-Ibig Multi-Purpose Loan Application Form MPLAF and fill in the blanks with your right info.

How to Apply for Pag IBIG Multi Purpose Loan. Who can avail of the Pag-IBIG Multi-Purpose Loan. How soon can I apply again for a Pag-ibig Multi-Purpose Loan or Short-term Loan.

The program shall be open to a Pag-IBIG member who satisfies the following requirements. How much may I borrow. Must have at least twenty-four 24 monthly contributions.

Paid at least six 6 monthly amortizations. A member with an existing Pag-IBIG Fund MPL can still apply for another MPL as long as she has paid at least six 6 monthly contributions in the existing MPL and is updated with monthly contribution payments prior to the enhanced community quarantine done on 16 March 2020. Thank you for visiting our website.

Pag-IBIG member who has made at least 24 monthly savings MS and has total savings equivalent to. According to an article on Cash Mart the Pag-IBIG Salary Loan renewal is possible after paying at least six 6 monthly amortizations of your existing loan. Your outstanding Multi-Purpose Loan obligation will be applied for your new loan proceeds and the net proceeds will be released to you.

For someone getting a new loan there are only four PAG IBIG loan requirements that you need to meet. The Home Development Mutual Fund HDMF more popularly known as the Pag-IBIG Fund has made filing for Multi-Purpose Loans MPL and Calamity Loans easierIt now accepts online loan applications via its website or email. Has made at least twenty-four 24 monthly mandatory savings MS.

You must be an actively contributing member with at least twenty-four 24 monthly membership savings MS and sufficient proof of income to qualify. You can apply again after you have paid at least 6 monthly amortizations and you have made 5 monthly contributions or savings within the last 6 months prior to new loan application. Submit the following Pag-IBIG Loan requirements.

Photocopy of your previous cash card. Pag-IBIG Fund Multipurpose Loan Borrower Eligibility Requirement New Loan. You need to showcase that you were an active member at the time of loan application.

Be an active Pag-IBIG Fund Member at the time of application Have a total Fund savings of at least 4800 or at least a total of 24 months Membership Savings contributions Have made at least one Membership Savings contribution within the last six months prior to the date of the loan application Have a document of proof of income. For members who have withdrawn their MS due to membership maturity the reckoning date of the updated 24 MS shall be the first MS following the month the member qualified to withdraw his MS due to membership maturity. You need to contribute at least 24 months to PAG-IBIG.

The move was a response to many Pag-IBIG members clamoring for financial aid during this time when work is suspended and everybody is forced to stay. What are the Eligibility Requirements for Pag-IBIG Multi-Purpose Loan Application. On the other hand the new loan shall applied to the borrowers outstanding MPL obligation.

Pag-IBIG Loan renewal You may renew your Pag-IBIG Salary Loan application granted that you have paid for at least six months of amortization. The outstanding loan balance will be deducted from the new loan. Copy of 1 month payslip.

To Apply For A Loan Renewal A Pag ibig Member Must Have. The Pag-IBIG Multi-Purpose Loan is open only to Pag-IBIG Fund Members who meet the following basic qualifications. Multi-Purpose Loan Application Form MPLAF HQP-SLF-065 1 Original Proof of Income For Formally-employed The Certificate of Net Pay portion at the back of application form must be accomplished by the employer or submit photocopy of one 1 month latest payslip duly authenticated by the companys authorized signatory.

Pag Ibig Salary Loan Online Application 2020 Fill Online Printable Fillable Blank Pdffiller

Pag Ibig Multi Purpose Application Form

Pag Ibig Fund Hdmf We Want You To Be Safe For Everyone S Health And Safety Starting Wednesday 25 March 2020 We Will Stop Accepting Applications Via Drop Box For Multi Purpose Loan Mpl

How To Check Pagibig Loan Balance Payment History Pag Ibig Housing Loan 2020 Youtube

How To Know Your Pag Ibig Savings Or Contributions Online Quick Guide

Komentar

Posting Komentar