How To Follow Up Pag Ibig Multi Purpose Loan

The steps are as follows. Here are a few examples where you can use your MPL.

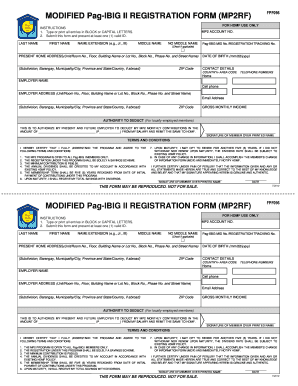

Pag Ibig Form Fill Online Printable Fillable Blank Pdffiller

Print fill up and sign.

How to follow up pag ibig multi purpose loan. Download the MPL or Calamity Loan application form from the Pag-IBIG Fund website. According to Pag-IBIG downloading the application form printing it out and then filling it up and signing it and sending it to your employer or authorized company human resource HR representative or Fund Coordinator via email is an option for those who have printers at home. A member can borrow up to 80 of their Pag-IBIG Regular Savings and can be processed in as fast as 2 days.

The Pag-IBIG Multi-Purpose Loan is essentially a financial assistance to Pag-IBIG Member that they can use for any of the following purpose. Consolidation takes weeks before its completed. Both the calamity and MPL are payable within 24 months and the payment will be deducted from your monthly salary.

Read more below and learn how to secure cash through the Pag-IBIG Multi-Purpose Loan. -Photocopy of at least two 2 valid IDs. How much can you loan from Pag-IBIG Multi-Purpose Loan.

Posted at least twenty-four 24 monthly savings. This is why its important that you send a follow up email once a month. This is the primary loan service offered by the Pag-IBIG fund.

The loan repayment will start on the 3rd month from the release date of your loan. You can apply again after you have paid at least 6 monthly amortizations and you have made 5 monthly contributions or savings within the last 6 months prior to new loan application. To compute how much you may borrow if you will apply for Pag-IBIG Cash Salary Loan do the following.

If you have a printer follow these steps. If with an existing Pag-IBIG Housing Loan Multi-Purpose Loan MPL andor Calamity Loan all outstanding dues must be paid up to date. Minor Home Improvement Take note that this is only for minor home improvements.

Tuition Fee and other education-related expenses. How soon can I apply again for a Pag-ibig Multi-Purpose Loan or Short-term Loan. Key-in your cashcard number and click Check Cash Card Status.

The Pag-IBIG Fund Multi-Purpose Loan or MPL Program is a cash loan that qualified members may secure to assist them with any immediate financial need. Step 2 Fill-up the form and send to your HR Authorized representative or Fund coordinator for signing purposes. Hi GuysWelcome to my channel.

Must be a resident of an area declared under a state of calamity. The total amount of your contribution in months will then be multiplied to the following loan value percentages. Heres how you can submit your Multi-Purpose Loan MPL application via Email.

Sometimes referred to as personal loan the Multi-purpose loan is one of two short-term loans available to Pag-IBIG members as the need arises. Check the percentage where the number of your total monthly contributions falls to. To be eligible for the multi-purpose loan offer the borrower must have.

How to Apply for Pag IBIG Multi Purpose Loan. Step 3 Once approved your HR authorized representative or fund coordinator needs to send it back to you. Heres how to apply for Pag-IBIG MPL or Calamity Loan.

Check the number of your total monthly contributions to Pag-IBIG Fund Multiply the total number of your monthly contributions with Php 20000. Additional capital for a small business. Provide the details of your cashcard where you will receive your loan proceeds.

1Download the Pag-Ibig Multi-Purpose Loan Application Form MPLAF and fill in the blanks with your right info. Please like and follow me onInstagram and FacebookmyramicaaThanks for watching. -Proof of income or latest pay slips of your one month salary.

Accomplish the Multi-Purpose Loan Application Form which can be seen via the Pag-IBIG website no need for signature. The other popular program is the Multi-Purpose Loan MPL or sometimes referred to as Personal Loan. Send your inquiry at contactuspagibigfundgovph.

The outstanding loan balance will be deducted from the new loan. Contact PAG-IBIG via email and follow up for your consolidation or merging request. The Pag-IBIG Fund Multi-Purpose Loan or MPL is a cash loan designed to help our members with any immediate financial need.

HOW TO APPLY FOR A PAG-IBIG MULTI-PURPOSE LOANStep-by-step Myra Mica - YouTube. At least paid twenty-four 24 monthly contributions. Yes you can apply for a Pag-IBIG multi-purpose loan online in just a few simple steps.

E-mail filing of loan applications for Multi-Purpose Loan MPL and Calamity Loan can be done during the enhanced community quarantine. A total of P200 per month goes to your PAG-IBIG contribution with the P100 coming from your monthly salary and the other P100 paid by your employer. To apply for a New Loan a Pag ibig member must have.

How to pay for your Pag-IBIG loans. Has adequate proof of income. Download the required application form from the Pag-IBIG website and fill it out either manually or digitally.

Pag-IBIG MULTI-PURPOSE LOAN MPL APPLICATION FORM. Posted at least one 1 MS within the last six 6 months. For questions or to follow-up on your loan application please call 028724-4244 or chat us by clicking on the icon found at the bottom right of your screen.

Who Are Qualified Or Eligible To Borrow. For renovation works requiring larger amount of money you may want to avail of the Housing Loan. If you filled it out manually scan the document and compile it digitally.

His or her Pag-IBIG Housing Loan or Calamity Loan in default in case there is. Submit the following Pag-IBIG Loan requirements. Has made at least 1 MS for the past six 6 months preceding the date of application.

Two 2 witnesses shall sign the form as well. Provided a sufficient proof of income. Your subject must consist of your PAG-IBIG Number and Service Type Request.

Pag Ibig Loan Status Verification Mpl Calamity Loan Youtube

Pag Ibig Fund Cash Loan Application Now Online Execs Say Bmplus

7 Ways To Contact Pag Ibig Fund For Inquiries And Concerns Online Quick Guide

Pag Ibig Is Now Accepting Calamity Loan Applications Via Email Philippine Information Agency

How To Know Your Pag Ibig Savings Or Contributions Online Quick Guide

Komentar

Posting Komentar